Personal finance is as much about behavior as it is about money. In order to fully understand your finances, you need to fully understand yourself, where exactly you are emotionally, financially, and professionally, and only then can you actually determine exactly where you want to go. In this post I will try to generalize the process of building the foundations needed to understand personal finance. This will plant the seed to enable you to start planning, saving, and prepare for wherever you want to go.

Begin Evaluating Your Finances Today! (20mins - 1hr)

- Make a Budget. If you don’t have budget, get one. Budgets are never ever set in stone, think of it as a guideline and evaluation tool to learn more about yourself and your habits. You can always change your budget to adjust for what you’ve learned. I have had a budget for over 10 years now, and I still have to readjust budget at least once every couple months (but I still view weekly). There are hundreds of tools out there that can help you start. If you are just starting out, I’d recommend creating a simple budget on a spreadsheet first and then go to Mint.com.

- Create a Budget Spreadsheet. By manually creating your spreadsheet first, it will reveal your perceived expenditures allowing you to compare with how much income you are taking home and, hopefully, see what you have leftover. ChristianPF.com has compiled a list of 10 free budget spreadsheets here. Take your pick! You basically have to fill in the blanks of the different spending categories to create the big picture of, your budget.

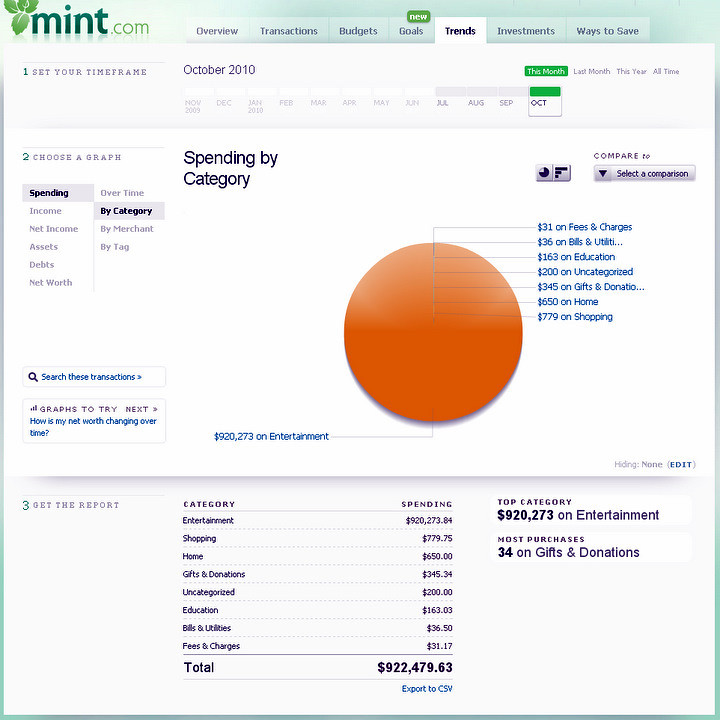

Next, Sign up for Mint.com. Mint.com is a free service, provided by the makers of TurboTax, Quicken, and Quickbooks, which allows you to link your bank, credit card, loan, retirement, and other financial institution accounts to create a “dashboard” of all your finances. Many companies try to recreate what Mint has done, i.e. Chase Blueprint, USAA Money Manager, etc… but what they don’t do is talk to other institutions, so using those tools will never be as comprehensive as Mint. Once you link your accounts, Mint.com may automatically create a budget for you in the budget section. If it hasn’t, use your spreadsheet to populate your budget. The purpose of using Mint, is to get an easy to use, real-time snapshot of your spending and budgeting. Check on Mint weekly and I guarantee you will find expenditures on there that you did not enter in your budget spreadsheet. For the first two to three months use Mint to learn more about your cash flow (how you make, spend, and save) and compare/adjust your spreadsheet. It will reveal a lot!

Next, Sign up for Mint.com. Mint.com is a free service, provided by the makers of TurboTax, Quicken, and Quickbooks, which allows you to link your bank, credit card, loan, retirement, and other financial institution accounts to create a “dashboard” of all your finances. Many companies try to recreate what Mint has done, i.e. Chase Blueprint, USAA Money Manager, etc… but what they don’t do is talk to other institutions, so using those tools will never be as comprehensive as Mint. Once you link your accounts, Mint.com may automatically create a budget for you in the budget section. If it hasn’t, use your spreadsheet to populate your budget. The purpose of using Mint, is to get an easy to use, real-time snapshot of your spending and budgeting. Check on Mint weekly and I guarantee you will find expenditures on there that you did not enter in your budget spreadsheet. For the first two to three months use Mint to learn more about your cash flow (how you make, spend, and save) and compare/adjust your spreadsheet. It will reveal a lot!- Alternatives:YNAB is budgeting on steroids. For those of you who do not feel comfortable signing up for Mint.com and providing your banking institution credentials, YNAB is the way to go. From my understanding, you download your records from your financial institutions, and upload it into YNAB. PersonalCapital.com is geared more towards investing but does offer a few tools on cash flow.

-

Check Your Credit Report. Because of the Fair Credit Reporting Act of 2003, you are eligible to receive three free credit reports from the different credit reporting agencies every year at annualcreditreport.com. You can check all three once a year or spread it out, I usually check one agency every four months. Check out the video tutorial provided by DoughRoller. What to check for:

- Late Payments, Collections, Judgments, Liens, Bankruptcies. These all have a great influence your credit score.

- Debt-to-Credit Ratio. Add up your debt and divide by your account maximum totals. You are shooting for less than 30%, ideally less than 10%.

- Hard Inquiries. Inquiries that requires an application filled out by you.

- Run A Security Check. With one third of data breaches resulting in identity theft, you can only imagine home many cases the Home Depot and Target breaches resulted in. Don’t be a victim! I will show you different methods to secure your financial institution logins and your online browsing, in general.

- Review Credit Report hard Inquiries. If they are not filed by you, they may be signs of identity theft.

- Use Secure Login Credentials. If someone hacks your email account, you’re just as vulnerable as someone hacking into your financial accounts associated with that email. How secure is your password? Check here. Make sure your login is secure, on this article on Lifehacker. If you want a TLDR: take 4 or more random words to make an easy to remember and secure password.

- You can also use a password manager, but to me it seems more of a hassle. I do use LastPass, but only on my computer at home.

- Use Two-Step Verification. More about two-step verification on this video. Most financial institutions and email accounts have this capability. Although most people see it as an inconvenience, it is a very secure method to verify your identity. It takes two things to login: 1) your secure password; and 2) an item physically with you (usually your phone).

- Ensure your Devices are Up-To-Date and Secure. This means checking:

- OS updates. Check with Windows or Mac OS for latest updates.

- Install a Antivirus and/or Malware scanner. I could go into a long discussion about this, but I’m not. Just make sure you have a good antivirus and malware protection on your device. Most internet service providers provide one for free and there are also some good free ones out there.

- HTTPS Browsing. Always check to see the website you are on is spelled correctly and is using HTTPS with an up-to-date security certificate.

I know that was a lot of information, but I believe these steps are necessary in order to begin taking charge of your finances: make a budget, check your credit, and secure your devices. By creating and following a budget, you will get a better understanding of your finances which can allow you to:

- Get out of debt

- Create an Emergency Fund

- Save for Retirement

- Save for a Down Payment on a House

By checking your credit and securing your devices, you are protecting yourself from identity theft.

There are hundreds of resources out there on personal finance, these are my favorite blogs:

- DoughRoller.net - My favorite blogger/podcast

- Mr. Money Moustache - Awesome guy who saved a ton and retired early

- Kitces Blog - Knowledgeable guy who goes into financial specifics

- Christian Personal Finance - Great financial advice, that is not just for Christians

- The Military Wallet - Financial blog for members of the military.

These books are highly recommended by several of those bloggers:

- Total Money Makeover by Dave Ramsey

- Your Money or Your Life by Vicki Robin

- The Richest Man in Babylon by George S. Clason